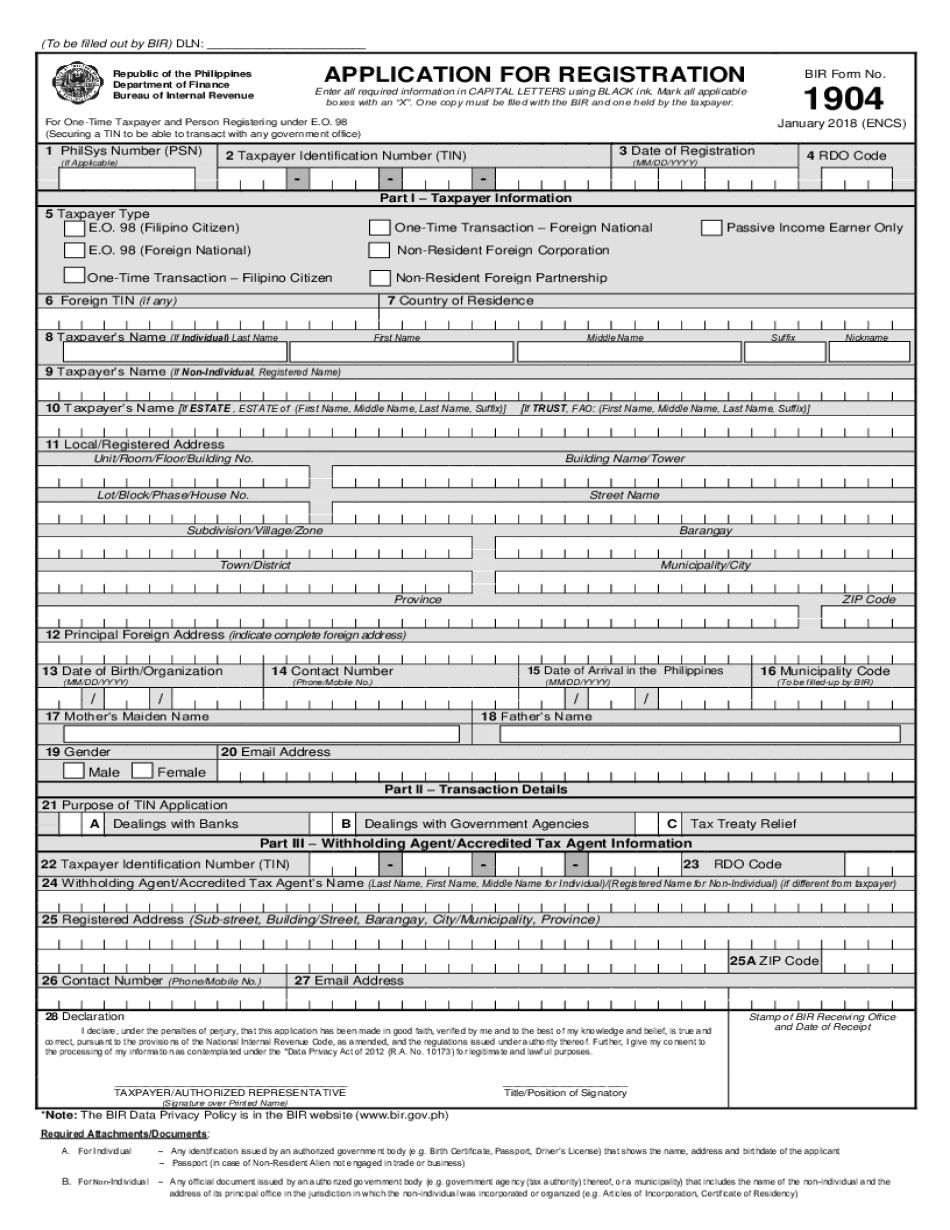

Guide on filling out bi or form number 1904 bi or form number 1904 is to be accomplished by one-time taxpayer and persons registering and applying for a tin under eo98 executive order number 98 requires all those who are transacting with any government office to secure a tax identification number or tin this has to be filed with the do having jurisdiction over the place where property is located for one-time taxpayer or place of residence for applicants under eo98 this application should be filed before payment of any tax due or before filing of return or before the issuance of tin under eo98 for example let's say you bought a real property in banyan Laguna to pay the necessary taxes you will be needing your 10 before payment if you don't have an existing tin you have to secure a tin using bi or form number 1904 please be reminded that all required information should be written in capital letters using black ink mark all applicable boxes with an x note that this must be prepared in duplicate copies one for the Dior and one to be held by the taxpayer start with answering item number five in our case mark an x at eo98 Filipino citizen then proceed with item number eight by writing your last name then first name and middle name also indicate your suffix if there's any don't forget to write your nickname as well next write your complete local or registered address on the space provided in item 11 state you date of birth using the month day and year format right also your contact number in item number 14 for item number 17 and 18 state your complete mother's maiden name and father's name mark an x for your gender and write...

Award-winning PDF software

How to prepare Bir Form 1904

About Bir Form 1904

BIR Form 1904, also known as the Application for Registration Information Update, is a document issued by the Bureau of Internal Revenue (BIR) in the Philippines. It is used to register new businesses or update the registration details of existing entities. BIR Form 1904 is required for various purposes, including the following: 1. New business registration: It is used by individuals or entities that are starting a new business in the Philippines. This form is submitted to the BIR to obtain a Tax Identification Number (TIN) and register for tax compliance. 2. Information update: Existing businesses may need BIR Form 1904 to update their registration details. Changes in business information like address, contact numbers, or business activities are reported through this form. 3. Branch registration: If a business entity plans to establish a branch or additional place of business, BIR Form 1904 should be accomplished to register the newly established branch for tax purposes. 4. Transfer of business ownership: In the case of transferring business ownership, such as from individual to corporation, BIR Form 1904 is necessary to update the registration information reflecting the new owner's details. 5. Reinstatement: If a taxpayer's registration has been canceled due to noncompliance or other reasons, BIR Form 1904 is required to reinstate the taxpayer's registration to comply with tax obligations. Overall, BIR Form 1904 is essential for individuals or entities in the Philippines who are establishing new businesses, updating or transferring their registration details, or reinstating their registration with the BIR. It serves as a vital document to ensure tax compliance and facilitate proper administration of taxes in the country.

Get Bir Form 1904 and simplify your daily document administration

- Locate Bir Form 1904 and begin modifying it by clicking on Get Form.

- Begin completing your form and include the data it needs.

- Benefit from our extensive modifying toolset that allows you to add notes and leave comments, if required.

- Review your form and double-check if the details you filled in is correct.

- Swiftly correct any mistake you made when altering your form or go back to the previous version of your file.

- eSign your form easily by drawing, typing, or capturing a picture of your signature.

- Preserve adjustments by clicking Done and after that download or send your form.

- Submit your form by email, link-to-fill, fax, or print it.

- Choose Notarize to do this task on your form online using our eNotary, if necessary.

- Safely store your approved papers on your PC.

Modifying Bir Form 1904 is an simple and user-friendly process that requires no previous training. Find all you need in one editor without the need of constantly changing in between various platforms. Locate more forms, complete and preserve them in the format of your choice, and simplify your document administration in a single click. Before submitting or sending your form, double-check details you provided and quickly fix mistakes if necessary. In case you have any questions, get in touch with our Customer Support Team to assist you.

Video instructions and help with filling out and completing Bir Form 1904